Summary

- Global electric car sales Feb. 2023 were up 49% YoY to 14% share. China sales up 56% YoY to 33% share. Europe up 14% YoY to 20% share.

- EV market news – EV demand sentiment was weighed on by some automakers in China heavily discounting ICE vehicles in advance of new emissions standards due July 1, 2023.

- EV company news – BYD aims to sell at least 3 million vehicles this year. Tesla vows to halve EV production costs on their new platform for a cheaper EV.

- Ford tripling F-150 Lightning, doubling Mach E production in 2023. Mitsubishi Motors plays catchup with plans to electrify fleet by 2035. GM’s EV push stalls amid slow rollouts for GMC Hummer, Cadillac Lyriq.

- I do much more than just articles at Trend Investing: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

Welcome to the March 2023 edition of Electric Vehicle [EV] company news.

March saw February global plugin electric car sales improve strongly after a slow January.

In March we heard stories of massive ICE car discounting (as much as 50% for some models) in China to beat the July 1, 2023 emissions deadline for change in emissions standards in China. This worked against EV sales in China but should only be short term.

Global electric car sales as of end February 2023

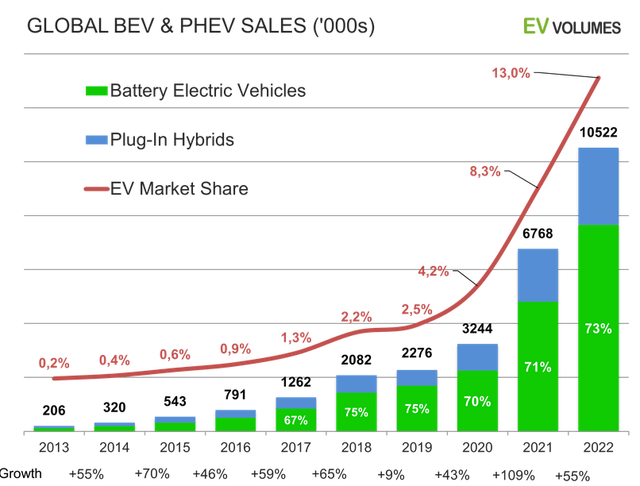

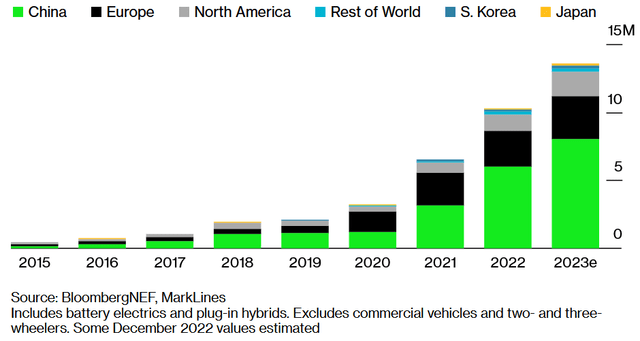

Global plugin electric car were 812,000 sales in February 2023, up 49% on February 2022 sales. Global plugin electric car market share in February was 14%, and 13% YTD.

China plugin electric car sales were ~500,000 sales in February 2023, up 56% on February 2022 sales. Electric car market share in China for February was 33%, and 30% YTD.

Europe plugin electric car sales were 182,000 in February 2023, up 14% YoY, reaching 20% market share and 19% YTD. Norway reached 90% share, Sweden 54%, Netherlands 37%, Germany 22%, France 24%, and UK ~23% share in February 2023.

USA plugin electric car sales were reported by Bloomberg in March 2023 as having reached a 7.6% market share.

Note: Globally 100% battery electric vehicles represented 70% market share in February 2023 and 68% YTD.

Note: The above sales include light commercial vehicles.

Note: An acknowledgement to Jose Pontes and the team at CleanTechnica Sales for their work compiling all the electric car sales quoted above and charts below. Also the team at EV-Volumes for their great work.

CleanTechnica

EV-Volumes

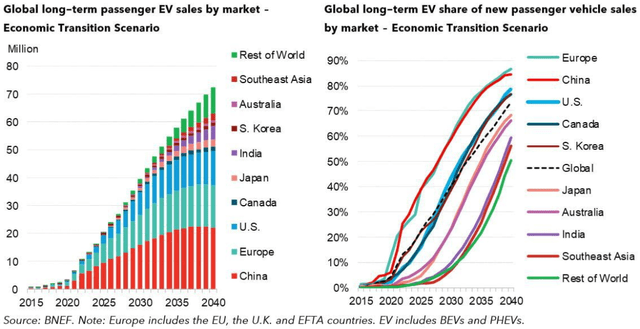

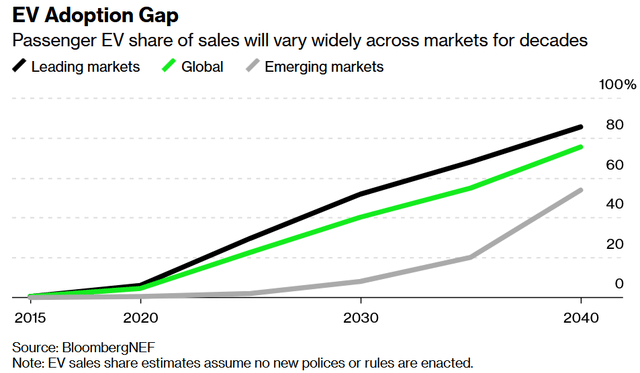

BloombergNEF

Mining.com

BloombergNEF

BloombergNEF

EV market news

On February 20 Bloomberg reported:

Ola plans to build world’s largest electric vehicle hub in India……with an investment of 76.1 billion rupees ($920 million) to localize the supply chain for cleaner transport. The hub, spanning 2,000 acres (809 hectares) in the southern Indian state of Tamil Nadu, will be used for manufacturing electric two-wheelers, cars and battery cells, in addition to housing vendor and supplier parks……

On March 7 Bloomberg reported:

China’s Provinces offer EV sweeteners as national subsidies fade. Auto executives are watching closely for what, if any, new state support for the electric-vehicle sector may emerge from this week’s annual legislative conference……..Beijing has said it’s working on new policies to support the industry. In the meantime, local governments have taken it upon themselves to stimulate demand…… Shanghai -…..can get one-time cash back of 10,000 yuan when they buy a new EV to replace an existing gasoline car. Beijing -……..Owners who de-register internal combustion engine cars that are one to six years old can receive 8,000 yuan, while those who replace ICE vehicles older than six years get 10,000 yuan…… Hubei – The province that counts Wuhan as its capital kicked off “the biggest car-sale subsidy season” this month, with cash back offers starting from 5,000 yuan…………..Hunan – This southern province will reimburse people 5,000 yuan if they de-register their used ICE car and purchase a new EV.

On March 9 Bloomberg reported:

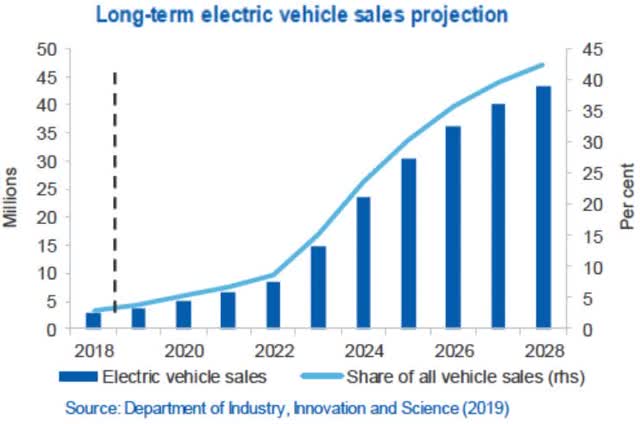

Carmakers can kiss pre-pandemic combustion car sales goodbye. It’s becoming clearer that vehicles burning gas and diesel are unlikely to ever get back to the level reached in 2017…….But with 2022 data now available, BNEF is confident the global market for internal combustion vehicles peaked in 2017 and is now in structural decline……..The picture was quite different in 2022. Combustion vehicle sales were down almost 20% from the peak, to 69 million, and plug-in vehicles jumped to 10.4 million……

On March 9 Bloomberg reported:

US electric cars set record with almost 300-mile average range. The average range for an EV in the US has quadrupled since 2011, and is today a third higher than the average globally……EV adoption appears to have reached a critical tipping point in the US, with battery-powered vehicles now accounting for 7.6% of car sales.

On March 10 Autocar reported:

Smartphone giant Xiaomi confirms 2024 launch for electric saloon. New Xiaomi MS11 is a Tesla Model 3 rival with a BYD battery option and high-level autonomy……

On March 10 Bloomberg reported:

VinFast EV production in US now not expected to start until 2025…… Phase one of the facility is expected to have an initial capacity of 150,000 vehicles a year” rising to 250,000 cars upon completion of phase two.

On March 16 Benchmark Mineral Intelligence reported:

US loosens IRA requirements with EU mineral supply deal…..European carmakers and raw material producers will “get access to US tax breaks,” Ursula von der Leyen, president of the European Commission, said…..

On March 16 the European Commission announced:

Critical Raw Materials: ensuring secure and sustainable supply chains for EU’s green and digital future…… The Regulation sets clear benchmarks for domestic capacities along the strategic raw material supply chain and to diversify EU supply by 2030:

At least 10% of the EU’s annual consumption for extraction,

At least 40% of the EU’s annual consumption for processing,

At least 15% of the EU’s annual consumption for recycling,

Not more than 65% of the Union’s annual consumption of each strategic raw material at any relevant stage of processing from a single third country………….

The proposed Regulation will be discussed and agreed by the European Parliament and the Council of the European Union before its adoption and entry into force.

On March 24 Share Cafe reported:

Chinese NEV industry hits a nasty patch of black ice……March has seen not only a slide in sales growth and price cutting for all types of NEVs (Battery and plug-ins/hybrids), especially after Tesla’s aggressive moves in January, but also a slide in the price of both lithium hydroxide and lithium carbonate. At the same time, more and more Chinese cities have started their own purchase subsidy schemes to replace the country-wide schemes that ended on December 31 – most notably Shanghai earlier this month and this week, Beijing.

Note: Benchmark Mineral Intelligence reported in March (paywalled):

Lithium chemicals pricing in China is weighed on by weak demand, compounded by discounts on internal combustion engine [ICE] vehicles…..EV demand sentiment was weighed on by some automakers in China heavily discounting ICE vehicles, by as much as 50% for some models, in order to shift excess inventory, particularly in advance of new emissions standards expected to come into effect on 1 July 2023…….

Note: Bold emphasis by the author.

On March 25 CNEVPOST reported:

CPCA expects China’s Mar NEV retail sales to rise 27.5% from Feb to 560,000 units…..retail sales of NEVs are expected to be 560,000 units, up 25.8 percent from a year ago and up 27.5 percent from February, with a penetration rate of 35.2 percent, according to the report.

On March 27 Bloomberg reported:

Turmoil in a Mega EV market is a good thing….Car companies are throwing in sweeteners while incumbents are trying to clear stocks of internal-combustion-engine vehicles that consumers will soon shun. EV makers are attempting to keep up with falling prices and rising competition. An imminent emissions regulation that kicks in this July is fueling the growing anxiety……

On March 29 Bloomberg Green Hyperdrive reported:

Growing love for electric SUVs tripled India’s lagging EV sales. Electric passenger vehicle sales in India tripled last year as demand for affordable, compact sports utility vehicles surged…….Electric vehicle sales in India stood at 49,800 last year, accounting for just 1.3% of 3.8 million passenger vehicles sold…. That has created room for foreign carmakers to expand in India’s nascent EV market. Warren Buffett-backed BYD Co. seeks to capture 40% of India’s EV market by 2030……

On March 29 France24 reported:

UN adopts landmark resolution to define global legal obligations on climate change. Ultimately co-sponsored by more than 130 member states, the resolution had been widely expected to be approved.

On March 31 Bloomberg reported:

Biden makes electric vehicle credits elusive in bid for US auto renaissance. Number of cars qualifying for IRA tax credits is set to shrink. Incentives for consumers, manufacturers still drive investment……. Specifically, the rules split the credit in two, with $3,750 available for vehicles with at least half of their battery components from North America, and the remainder if 40% of the value of raw materials in the battery are extracted or processed domestically, or in countries with US free-trade agreements. Those requirements will ramp up over time…….

On April 1 Electrek reported:

ICE car values plummet in China and it is the canary in the coal mine. A looming crisis is brewing in China, as hundreds of thousands of unsold, polluting gas-powered vehicles may be rendered unsellable due to incoming emissions rules. It’s another sign that the global auto industry isn’t ready for the shift to EVs and will be caught unawares if it doesn’t ramp EV production fast enough. The new Chinese emissions rules were announced all the way back in 2016 and are set to go into effect in July……

On April 6 Seeking Alpha reported:

Biden admin plans to propose ‘toughest-ever US curbs’ on auto pollution – report……The latest proposals, which are expected to be announced Wednesday in Detroit, are expected to crack down on emissions of CO2, nitrogen oxide, and other gasses. Model years 2027 through 2032 are anticipated to be in the crosshairs of the regulation, per Bloomberg.

EV company news

BYD Co. [SHE: 002594][HK:1211](OTCPK:BYDDY) (OTCPK:BYDDF)

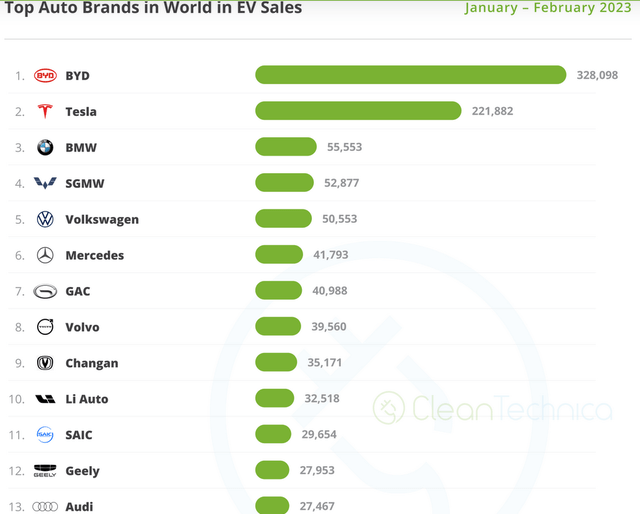

BYD is currently ranked the number 1 globally with 23.2% market share YTD. BYD is ranked number 1 in China with 40.5% market share YTD.

On March 17 CarNewsChina reported: “The 2023 BYD Han EV launched for 30,400 USD and received 5,000 orders in 4 hours.”

On March 21 Seeking Alpha reported:

BYD reportedly reduces shifts at multiple plants. Citing people familiar with the matter, Reuters reported on Tuesday that plants in both Xian and Shenzhen are reducing hours…..The sources indicated that the production pullback was enacted in response to weakening demand.

On March 28 Bloomberg reported:

BYD’s net income jumps more than 400% as EV shift takes hold…..Net income soared 446% to 16.6 billion yuan ($2.4 billion), the company said Tuesday, in line with the 16 billion to 17 billion yuan preliminary profit it reported on Jan. 30. Analysts had projected 16 billion yuan, according to data compiled by Bloomberg.

On March 30 The Driven reported:

EV maker BYD on track to take top spot in world’s biggest car market in 2023……BYD has sold 344,996 new energy vehicles (NEVs) in the first two months of the year……With over 200,000 NEVs expected to be sold in March, the company would surpass the half-a-million NEVs quarter milestone in 2023.

On March 30 CNEVPOST reported:

BYD aims to sell at least 3 million vehicles this year……and will strive to reach 3.6 million, said Wang Chuanfu, the company’s chairman and president……2.8 million will be in China and 800,000 in overseas markets…..BYD sold 1,868,543 vehicles in 2022, including 1,863,494 NEVs……Wang expects China’s NEV sales to be 8.5 million to 9 million units in 2023, with penetration rates of up to 40 to 45 percent, and possibly exceeding 50 percent in some months…….In China’s first-tier, second-tier and third-tier cities, consumers are already barely considering fuel vehicles when buying cars, Wang said.

Tesla Inc. (NASDAQ:TSLA)

Tesla is currently ranked the number 2 globally with 15% global market share YTD. Tesla is number 3 in China with 7.6% market share YTD. Tesla is number 5 in Europe with 9% market share YTD. Tesla is still the number 1 electric car seller in the US by far with ~65% market share.

On March 2 Reuters reported: “Tesla vows to halve EV production costs, Musk keeps affordable car plan under wraps.”

On March 6 Seeking Alpha reported: “Tesla slashes U.S. Model S and Model X prices to surge consumer demand.”

On March 7 Seeking Alpha reported:

Tesla may start production in Mexico as early as 2024…..according to the governor of Nuevo Leon…….The state’s governor Samuel Garcia indicated in an interview with Spanish outlet EFE that Tesla (TSLA) could break ground on its new factory before the end of March once final permits are granted. The first vehicles at the plant could be manufactured as early as next year.

On March 21 Seeking Alpha reported: “Tesla zooms out of Junk rating at Moody’s making it a blue-chip credit company.”

On March 23 Electrek reported:

Tesla expects to lose full $7,500 tax credit on its cheapest electric car. Tesla told employees that it expects to lose the full $7,500 federal tax credit on its cheapest electric car because the batteries come from China.

On March 25 Teslarati reported: “Tesla Giga Berlin ramps production to 5,000 vehicles per week.”

On March 27 Bloomberg reported:

Tesla overcomes Australia’s EV hostility with surge in sales. Teslas are becoming an increasingly common sight on Sydney’ streets as EVs finally make to start inroads in Australia…….The Model 3 is the country’s third-best selling car – electric or not – trailing only the traditional top-selling Ford Ranger and Toyota HiLux pickups.

On March 31 Bloomberg reported:

Tesla pursues building a new US plant with China’s dominant battery maker. Automaker discussed plans recently with White House officials. Texas under consideration for factory; location not finalized……The EV maker discussed plans involving Contemporary Amperex Technology Co. Ltd. with the White House in recent days……Tesla representatives sought clarity on the Inflation Reduction Act rules that the Biden administration is finalizing this week, according to some of the people.

On April 2 Seeking Alpha reported: “Tesla tops deliveries expectations with 422,875 cars moved in Q1.”

On April 4 Electrek reported:

Tesla prepares to make 4 million units of its cheap electric car, supply chain sources say. Tesla is preparing to make 4 million units of its next vehicle, a ~$25,000 electric car, based on supply chain sources coming out of China.

Investors can read our past Trend Investing article: “Tesla – A Look At The Positives And The Negatives”, where we rated the stock a buy. It was trading at USD 250 (post 5:1 stock split and 3:1 split is equivalent to USD 16.67). Investors can also read the latest Tesla Trend Investing article (discusses the potential of Tesla’s humanoid robot) here.

Volkswagen Group [Xetra:VOW](OTCPK:VWAGY) (OTCPK:VLKAF)/ Audi (OTCPK:AUDVF)/ Lamborghini/ Porsche (OTCPK:POAHF)/ Skoda/ Bentley

‘Volkswagen Group’ is currently ranked the number 3 top-selling global electric car manufacturer with 7.2% market share YTD, and 1st in Europe with 20.8% market share YTD.

On March 3 Volkswagen Group reported:

Volkswagen Group achieves solid annual results, significant increase in deliveries expected in 2023…..Deliveries of battery-electric vehicles (BEV) up by 26 percent totalling 572,100 units in 2022, share in group deliveries increases to 7 percent; Volkswagen on track for 20 percent BEV share of total deliveries in 2025 and 50 percent in 2030…..

On March 7 Electrek reported: “Volkswagen Group expects 8 in 10 passenger cars to be EVs by 2030 after boosting sales target…..” Note that this is a target for Volkswagen to sell 80% of its cars as EVs in Europe in 2030.

On March 14 CNBC reported:

Volkswagen announces five-year $193 billion investment plan as electrification gathers pace……announced plans to invest 180 billion euros ($192.6 billion) between 2023 and 2027, with more than two thirds targeting “electrification and digitalization.”

On March 15 Volkswagen Group reported: “World premiere of the ID. 2all concept: the electric car from Volkswagen costing less than 25,000 euros.” Highlights include:

- “ID. 2all shows the new Volkswagen design language, presentation of the production version in 2025.

- Range of up to 450 km, as spacious as a Golf, as affordable as a Polo….

- Production version will be based on the new MEB Entry platform.

- Acceleration of the electric offensive: ten new models by 2026.”

Volkswagen Group

On March 16 Bloomberg reported:

Volkswagen shows €25,000 EV to compete where Tesla has left an opening. ID. 2all concept is an homage to compact Polo and Golf models. German carmaker races Tesla to offer low-price, high-volume EV…..

On March 17 Volkswagen Group reported: “Gigafactory Valencia: PowerCo gives starting signal for construction of second cell factory.” In Spain with an initial 40GWh capacity.

On March 17 EV Central reported: “Audi confirms more than 10 EVs by 2025, including entry-level model.”

On March 17 Reuters reported:

Volkswagen joins China price war as new emissions rule looms. SAIC Volkswagen Automotive Co is offering 3.7 billion yuan ($537 million) in cash subsidies for car purchases in China, joining more than 40 brands in slashing prices ahead of a change in emissions rules in the world’s largest auto market. The joint venture between China’s SAIC Motor Corp Ltd (600104.SS) and Germany’s Volkswagen AG (VOWG_p.DE) is offering 15,000 yuan to 50,000 yuan in subsidies until April 30 for its full lineup, which includes the Teramont, Lavida and Phideon models, SAIC-VW said on its WeChat account late on Thursday.

On March 21 Seeking Alpha reported:

Volkswagen aims to be the global leader in cheap electric vehicles. Volkswagen AG (OTCPK:VLKAF) created ripples in the automobile industry by announcing that it plans to launch an electric vehicle for less than €20K ($21.6K). The new model called the ID.1 is being slated to arrive as early as 2026-2027. Last week, the German automaker showed off the ID. 2all, which will cost around €25,000 and arrive sometime in 2025.

On March 23 Volkswagen Group reported: “PowerCo and Umicore get official “go” to start joint venture for EU battery materials production…..”

Geely Automobile Holdings Ltd (OTCPK:GELYY, HK:0175), Volvo Cars, Kandi Technologies Group (NASDAQ:KNDI), Proton, Lotus, ZEEKR. (Note: Volvo Group is a separate company that makes e-trucks & e-buses)

Geely/Volvo is currently ranked number 4 in the global electric car manufacturer’s sales ranking with 6.2% global market share YTD. Volvo is ranked 3rd in Europe with 10.2% market share YTD.

On March 3 Volvo Cars reported:

Volvo Cars reports global sales of 51,286 in February……The sales growth was led by the company’s Recharge line up of fully electric and plug-in hybrid cars. Sales of Volvo Cars’ Recharge models made up 40 per cent of all Volvo cars sold globally during the month. The company’s fully electric car sales increased by 187 per cent compared with the same month last year and comprised 19 per cent of the total sales in February.

On March 21 Geely Automotive Holding Ltd reported:

Geely Automobile Holdings Limited announced annual results for the year ended 31 December 2022. Profit attributable to shareholders increased by 9% to RMB5.26 billion…..The sales volume of new energy vehicles (NEVs) (include battery electric vehicles and plug-in hybrid electric vehicles) (including the total sales volume# of “Lynk&Co” and “Livan” vehicles sold by the Group’s two 50%-owned joint ventures, namely the Lynk&Co JV and the Livan JV) increased drastically by 300% YoY to 328,727 units….. In particular, Zeekr Intelligent Technology Holding Limited (“Zeekr”), a subsidiary of the Group, made significant strides in the first full year expanding into the premium intelligent electric vehicle market, with a total of 71,941 units of its first model, “Zeekr 001”, being delivered during the year, ranking among the top in the new energy vehicles industry in terms of delivery volume growth.

On March 29 Reuters reported: “Geely to include eight Chinese powertrain plants in Renault JV -sources…..”

Wuling Automobile JV (SAIC 51%, GM 44%, Guangxi 5.9%), SAIC Motor Corporation Limited [SAIC] [CH:600104] (SAIC includes Roewe, MG, Baojun, Maxus)

SGMW (SAIC-GM-Wuling Automobile) is number 5 globally with 5.6% market share YTD. SAIC/GM/Wulin JV (SGMW) plus SAIC is 2nd in China with 8.4% share YTD.

On March 9 SAIC reported:

SAIC Motor reports 49.3% growth in overseas market…..According to official data, SAIC Motor sold 45,000 new energy vehicles in February, up 38.5 percent from the previous month, and 84,000 units were sold in overseas markets, up 49.3 percent year-on-year. Its self-owned brands including IM Motors and Rising Auto, and its joint ventures such as SAIC-GM’s Buick and Wuling Motor launched new energy intelligent connected vehicles, which are expected to boost the carmaker’s growth in the second quarter of the year.

On March 20 SAIC reported: “New shipping route helps SAIC Motor expand global market…..”

On March 29 SAIC-GM-Wuling (SGMW) reported:

SAIC-GM-Wuling launches Wuling Bin Guo EV in China…..The Bin Guo is 3,950 mm long, 1,708 mm wide and 1,580 mm high, with a segment-leading wheelbase of 2,560 mm, giving it a roomy interior and cargo space. It also comes with an extensive range of safety and connectivity features. Five Bin Guo variants with an EV range of 203 km and 333 km under CLTC conditions are priced between RMB 59,800 and RMB 83,800.

SAIC-GM-Wuling (SGMW)

tellantis N.V. (NYSE:STLA) (merger Fiat Chrysler Group (FCA) and the Peugeot Group (OTCPK:PEUGF)) Ferrari (Jeep, Chrysler, Dodge, and RAM are all owned by FCA)

Stellantis Group is currently ranked the number 6 in the global electric car manufacturer’s sales with 4.7% global market share YTD. Stellantis is ranked 2nd in Europe with 14.4% market share YTD.

On February 28 Stellantis N.V. reported: “Stellantis announces $155 million investment in three Indiana plants to support North American electrification goals.”

Highlights include:

- “Company to localize production of new electric drive module (EDM) in Kokomo.

- EDM provides all-in-one solution for electric vehicle powertrains, delivering improved performance at competitive cost.

- Investments to be made at Indiana Transmission, Kokomo Transmission and Kokomo Casting Plants.

- More than 265 jobs retained.

- Total investments in Indiana since 2020 to support electrification goals grow to nearly $3.3 billion, including gigafactory joint venture with Samsung SDI.

- Announcement aligns with Company’s long-term strategy to reach 50% U.S. battery electric vehicle sales by 2030, starting with the first fully electric

- Ram vehicles from 2023 and Jeep from 2024.”

On March 22 Stellantis N.V. reported: “Stellantis invests €130 Million in Eisenach assembly plant in Germany for electric Opel Grandland Successor.”

On March 25 Car and Driver reported:

Ram gives dealers a preview of mid-size EV pickup concept: Report. The electric pickup concept reportedly shares a lot of similarities to the Ram 1500 Revolution concept shown at CES earlier this year.

BMW (OTCPK:BMWYY), Mini, Rolls-Royce

BMW Group is currently ranked the number 7 global electric car manufacturer with 4.3% global market share YTD. BMW Group is ranked 4th in Europe with 9.5% market share YTD.

On March 15 BMW Group reported: “BMW Group expects profitable growth in 2023 – through dynamic BEV ramp-up and high-end premium segment.” Highlights include:

- “Zipse: “Proven strengths, future-oriented technologies and NEUE KLASSE as a recipe for success”.\

- EBIT margin for 2023 expected within 8-10% range.

- High demand: 15% BEV share in 2023.

- Dynamic BEV growth in coming years.

- Double-digit growth in high-end segment in 2023.

- Further decrease in CO₂ emissions planned for 2023…..”

Hyundai (OTC:HYMTF), Kia (OTC:KIMTF)

Hyundai-Kia Group is currently ranked number 8 in the global electric car manufacturer’s sales ranking with 3.5% market share YTD.

On March 2 Kia reported:

Kia announces February 2023 global sales results…..In 2023, Kia aims to achieve global sales of 3.2 million units, with a focus on the sales of competitive new models such as the all-electric large SUV EV9.

On March 8 Hyundai reported: “Hyundai IONIQ 6 named among top three finalists in 2023 World Car Awards.”

On March 15 Kia reported: “The Kia EV9 revealed: Groundbreaking EV fusing progressive, bold design with authentic SUV character.” Highlights include:

“……EV9 readied to debut globally later this month, accelerating the brand’s transformation towards a sustainable mobility solutions provider……its first three-row electric flagship SUV.”

Kia

On March 21 The Driven reported:

Kia and Hyundai mini EVs to hit the streets in 2023……The news of Hyundai considering LFP batteries comes on the back of Kia’s upcoming launch of its next-generation Ray EV. This vehicle is mainly sold in Kia’s home market of South Korea…….The Ray EV is designed to have a smaller battery allowing it to do mainly city commutes. With the use of LFP batteries from CATL, Kia can lower the price of the Ray EV offering allowing more buyers to be able to get behind the wheel of a city electric car.

Daimler-Mercedes (OTCPK:MBGAF, OTCPK:DTRUY) (Smart – 50% JV between Daimler & Geely) (NB: A proposal to rename Daimler to Mercedes Benz)

Daimler-Mercedes is ranked number 9 globally with ~2.8% market share YTD. Mercedes Group is ranked 2nd in Europe with 8.2% market share YTD.

On March 7 Mercedes Blog reported: “Mercedes-Benz kicks off the construction of Battery Recycling Factory in Germany…..”

On March 19 Reuters reported:

Mercedes set to invest billions in e-vehicles plants. Mercedes (MBGn.DE) will invest billions of dollars to modernise its plants in China, Germany and Hungary over the coming years, magazine Automobilwoche reported, as the carmaker prepares to switch to electric vehicles and cut emissions.

On March 27 Mercedes-Benz reported: “Mercedes-Benz achieves next milestone in raw materials procurement for EV ramp-up.” Highlights include:

“Local sourcing: Strategic partner Rock Tech Lithium Inc. breaks ground for lithium factory in Guben, Brandenburg, to supply Mercedes-Benz with battery-grade lithium hydroxide starting in 2026 -starting with a qualification period……”

GAC Group (Guangzhou Automobile Group Co. Ltd.)

GAC Group is currently ranked number 10 in the global electric car manufacturer’s sales ranking with 2.8% market share YTD.

On March 8 Car News China reported:

GAC AION Y Younger electric SUV launched in China with a 430 km range…..This is the AION Y Younger, a facelift of the current AION Y models on the market. Only one model was launched and priced at 119,800 RMB (17,200 USD). As a facelift model, the exterior and interior designs largely remained the same, only the powertrain is upgraded.

Great Wall Motor [HK:2333] (OTCPK:GWLLF) (OTCPK:GWLLY) [ORA]

On March 10 Bloomberg reported:

Great Wall latest Chinese Automaker to embrace green car future. Great Wall Motor Co., the maker of Haval SUVs and pickup trucks, unveiled its new energy vehicle strategy Friday evening, pledging to double down on plug-in hybrid electric technology and becoming the latest traditional Chinese auto company to play catchup as the shift toward cleaner cars accelerates.

On March 17 GWM reported: “GWM signs agreement with Cycle & Carriage to bring in intelligent NEV models to Singapore.”

On March 29 GWM reported: “GWM Launches TANK500 HEV at Bangkok International Motor Show……”

GWM

On March 8 The Wall Street Journal reported:

GM’s EV push stalls amid slow rollouts for GMC Hummer, Cadillac Lyriq. Auto maker aims to increase electric-vehicle output this year.

On April 4 CNBC reported:

GM overtakes Ford as second-best seller of EVs in U.S. but still trails Tesla by a wide margin….. GM on Monday said it sold 20,670 EVs during the first three months of the year. Ford, which was No. 2 last year, reported EV sales Tuesday of 10,866 over the same time frame.

Ford (NYSE:F)

On March 3 Electrek reported: “Ford tripling F-150 Lightning, doubling Mach E production in 2023.”

On March 21 Ford reported: “Ford electrifies an iconic brand with the introduction of the new, all-electric explorer engineered and built in Europe.” Highlights include:

“……All-electric Explorer offers an outstanding digital experience with a fully loaded infotainment system, 15-inch movable screen, wireless app integration and advanced driver assistance…..

Explorer will take road trips in its stride, with charging from 10-80 per cent in 25 minutes…….”

The new all-electric Ford Explorer

Ford

On March 23 Bloomberg reported:

Ford sees electric-vehicle losses growing to $3 Billion in 2023. Ford Motor Co. predicts losses in its electric vehicle business will grow to $3 billion this year as it spends big on new models and factories……Ford reiterated its goal to reach an 8% margin, before interest and taxes, on electric vehicles by late 2026.

On March 24 CNBC reported:

Ford plans to build 500,000 EVs annually at its $5.6 billion Tennessee campus…..The first and only product to be announced thus far for the plant is a next-generation electric truck, which Ford has code-named “T3,” short for “TrustTheTruck.” Ford and battery supplier SK On are investing $5.6 billion in BlueOval City, which is on track to begin production in 2025, Ford said Friday.

Li-Auto (LI) [HK:2015]

On March 1 Li-Auto reported:

Li Auto Inc. February 2023 delivery update…..delivered 16,620 vehicles in February 2023, up 97.5% year over year…..

NIO Inc. (NIO)

On March 1 NIO Inc reported: “NIO Inc. reports unaudited fourth quarter and full year 2022 financial results.”

On March 22 Bloomberg reported: “EV-maker Nio surges; ‘Very Confident’ of hitting sales goal.” Highlights include:

“Chinese carmaker expects to double sales to 250,000 this year.

Price war shows China has ‘too many automakers,’ CFO Feng says.”

On March 28 Reuters reported: “China’s Nio opens trial for high-speed EV battery swapping stations.”

XPeng Inc. (Xiaopeng Motors) (XPEV) [HK:9868]

On March 1 XPeng Inc. reported:

XPENG announces vehicle delivery results for February 2023…..In February 2023, XPENG delivered 6,010 Smart EVs, representing a 15% increase over the prior month.

On March 10 XPeng Inc. reported: “XPENG launches new P7i Sports Sedan in China.”

XPeng New P7i Sports Sedan

XPeng Inc.

On March 17 XPeng Inc. reported: “XPENG reports fourth quarter and fiscal year 2022 unaudited financial results.” Highlights include:

“Cash and cash equivalents, restricted cash, short-term investments and time deposits were RMB38.25 billion (US$5.55 billion) as of December 31, 2022.

Quarterly total revenues were RMB5.14 billion, a 39.9% decrease year-over-year.

Quarterly vehicle deliveries were 22,204, a 46.8% decrease year-over-year.

Quarterly gross margin was 8.7%, a decrease of 3.3 percentage points year-over-year.

Full year vehicle deliveries reached 120,757, a 23.0% increase year-over-year.

Full year revenues reached RMB26.86 billion.

Full year gross margin was 11.5%, a decrease of 1 percentage point year-over-year.”

Renault [FR:RNO] (OTC:RNSDF)/ Nissan (OTCPK:NSANY)/ Mitsubishi (OTCPK:MSBHY, OTCPK:MMTOF)

On March 10 Bloomberg reported:

Mitsubishi Motors plays catchup with plans to electrify fleet by 2035……. Mitsubishi Motors Corp. will electrify 100% of the cars it sells worldwide by fiscal 2035, joining other Japanese automakers seeking to catch up with competitors in the US, China and Europe in the global industry’s shift to greener vehicles. Japan’s seventh-largest carmaker plans to invest as much as ¥1.8 trillion ($13.1 billion) on electrification by 2030, according to a briefing Friday.

On March 10 Mitsubishi reported: “Mitsubishi Motors announces its mid-term business plan, challenge 2025, to further growth & the next generation.”

Polestar Automotive Holding UK Limited (PSNY)

On March 2 Polestar reported: “Polestar releases fourth quarter and full year 2022 financial results.” Highlights include:

- “Total revenue of USD 2.5 billion in 2022, an increase of 84% year on year.

- 51,491 cars delivered in 2022, compared to 28,677 in 2021, an increase of 80%.

- Cash and cash equivalents of USD 974 million as of December 31, 2022.”

On March 21 Polestar reported: “Polestar 2 BST edition 230 explores performance design.”

Polestar

Beijing Automotive Group Co. (BAIC)(includes Arcfox) [HK:1958) (OTC:BCCMY)

On March 13 BAIC announced:

BAIC GROUP and CATL established in-depth cooperation and signed Memorandum of Cooperation on battery cells.

Lucid Group (LCID)

On March 17 Lucid Group reported: “Lucid opens new retail studio location in California……”

On March 28 Teslarati reported:

Lucid to lay off 1,300 employees for $24-$30M restructuring plan. On Tuesday, March 2, Lucid Group, Inc. announced plans to lay off 18% of its workforce……The electric vehicle company expects to incur around $24 million to $30 million in charges due to its restructuring plan. Most charges will go to severance payments, employee benefits, and stock-based compensation. The layoffs will include executive positions.

Rivian Automotive (RIVN)

On March 4 Reuters reported:

Rivian stands by 2023 production target despite media report. Rivian Automotive Inc (RIVN.O) on Friday said it was sticking to its official production forecast of 50,000 electric vehicles in 2023 after a Bloomberg news report said its executives had told employees it could possibly produce as many as 62,000 this year.

Toyota (NYSE:TM)/ Lexus

On March 1 Toyota reported: “Toyota launches all-new Prius PHEV in Japan.”

On March 3 Electrek reported:

First Toyota and BYD co-developed electric bZ3 rolls off the line in China for under $30K…..The co-developed Toyota-FAW bZ3 EV starts at just over $27,000 (189,800 RMB), with deliveries expected to begin soon. Toyota officially announced the bZ3 EV in October 2022, its second model from its bZ (Beyond Zero) lineup of fully electric cars.

On March 9 Toyota reported:

Toyota to accelerate plant decarbonization efforts in Fukushima using hydrogen. Commencing operation of electrolysis equipment using Mirai technology…..

On March 22 Lexus reported:

Lexus announces lineup & pricing for all-electric RZ SUV…..Two RZ 450e grades will be offered initially: Luxury priced from $123,0001 and Sports Luxury from $135,000.1 Both are powered by a 71.4kWh lithium-ion battery unit producing 230kW of power and providing a driving range of 470kms2 ….

On April 7 Reuters reported:

Toyota looks to overhaul EV strategy as new CEO takes charge. After making sweeping changes to its leadership team, Japan’s Toyota Motor Corp (7203.T) is looking at a factory floor overhaul as it maps out a move to a new, dedicated platform for battery electric vehicles, four people familiar with the matter said. Koji Sato may confirm that new EV architecture is in the works at his first briefing as CEO on Friday, one of the people has said.

Tata Motors (TTM) group (Jaguar, Land Rover)

On March 2 Tata Motors reported:

Nexon EV makes a landmark entry into India Book of Records for the ‘Fastest’ K2K drive by an EV. Powered by an enhanced range of 453kms, the entire drive was successfully completed with the help of a robust public fast charging infrastructure creates 23 additional records on the go.

GreenPower Motor Company Inc. [TSXV:GPV] (GP)

On March 9 GreenPower Motor Company Inc. reported:

GreenPower delivers first all-electric EV Star Refrigerated Box Trucks to University of California San Diego…..

Workhorse Group Inc. (WKHS)

On March 1 Workhorse Group Inc. reported:

Workhorse Group reports fourth quarter and full year 2022 results….. Sales, net of returns and allowances, for the fourth quarter of 2022 were $3.4 million compared to $(2.0) million in the same period last year…… As of December 31, 2022, the Company had $99.3 million in cash and cash equivalents…..Sales, net of returns and allowances, for the full year 2022 were $5.0 million compared to ($0.9) million in 2021……

On March 8 Workhorse Group Inc. reported: “Workhorse Group to unveil W56 Step Van at the NTEA Work Truck Show®.”

Workhorse Group

Lion Electric (LEV)

On March 10 Lion Electric reported: “Lion Electric announces fourth quarter and fiscal 2022 results.” Highlights include:

“Delivery of 174 vehicles, an increase of 103 vehicles, as compared to the 71 delivered in the same period last year.

Revenue of $46.8 million, up $23.9 million, as compared to $22.9 million in Q4 2021.

Gross loss of $4.8 million as compared to gross profit of $2.2 million in Q4 2021.

Net loss of $4.6 million in Q4 2022

Nikola Corporation (NKLA)

On March 16 Nikola Corporation reported:

Nikola to complete battery manufacturing move from Cypress, Calif. to Coolidge, Ariz. by April 2023. Ahead of schedule, company expedites ability to bring manufacturing under one roof.

On March 28 Nikola Corporation reported: “Klean Industries and Nikola partner to convert truck fleets to Nikola Tre FCEVs and to co-develop green energy projects……”

On March 30 Nikola Corporation reported: “Nikola announces $100.0 million Public Offering of Common Stock……”

Honda [TYO:7267] (HMC) (OTCPK:HNDAF) AFEELA (Sony Honda Mobility JV)

On March 1 Honda reported: “LG Energy Solution and Honda break ground for new Joint Venture EV Battery Plant in Ohio.”

On March 15 Honda reported: “Honda announces next steps in preparation for U.S. EV production.” Highlights include:

“Marysville Auto Plant (MAP) will consolidate two assembly lines to retool for production of EVs and EV components.

Accord production will be transferred from MAP to the Indiana Auto Plant as MAP retools for EV production….”

Lordstown Motors (RIDE)

On March 6 Lordstown Motors reported: “Lordstown Motors reports fourth quarter and fiscal year 2022 financial results.” Highlights include:

- “Foxconn Investment of up to $170 million, subject to certain conditions; initial $52 million funded……

- Start of commercial sales of the EnduranceTM, an electric full-size pickup truck.

- Supplier quality and performance issues have limited production and sales; corrective actions underway.

- Ending cash and short-term investments of $221.7 million, significantly in excess of previous outlook.

- Reduced operating loss driven by spending discipline.”

- Mazda (OTCPK:MZDAY)

No EV news for the month.

Fisker Inc. (FSR)

On February 27 CarScoops reported:

Fisker Alaska EV truck to have ‘Amazing Features’ never before seen on pickups. Henrik Fisker said he’s super excited about their electric pickup truck…….

Fisker Alaska (source)

Fiskerati

On March 7 Green Car Reports reported: “Fisker teases $29,900 Pear EV; Ocean deliveries start soon.”

On March 8 Fisker reported: “Fisker announces Deftpower as European public charging platform provider with access to leading EU charging network through Fisker FLEXSM Charge app.”

On March 27 Fisker reported:

All-electric Fisker Ocean extreme achieves a combined WLTP range of up to 707 km/440 UK miles, the longest range of any battery electric SUV sold in Europe today……

Arrival (ARVL)

On March 9 Arrival reported:

Arrival’s preliminary fourth quarter and full year 2022 financial results. ended Q4 with $205 million of cash on hand.

On March 13 Arrival reported:

ARRIVAL announces $300m equity financing line and provides 2023 outlook…….Extraordinary General Meeting of Shareholders to approve reverse stock split.

EV & battery ETF

The Amplify Lithium & Battery Technology ETF (BATT) is a broad based EV related fund worth considering. It is currently a trading on a PE of 13.77. On their website they state: “BATT is a portfolio of companies generating significant revenue from the development, production and use of lithium battery technology, including: 1) battery storage solutions, 2) battery metals & materials, and 3) electric vehicles.

Other EV or EV related companies

Other EV companies we are following include Envirotech Vehicles (EVTV), Atlis Motors, Ayro, Inc. (AYRO), Blue Bird Corporation (BLBD), Blink Charging (BLNK), Byton (private), Canoo Holdings (GOEV), China Evergrande New Energy Vehicle Group [HK:3333], Chery Automobile Co. Ltd. (private), Didi Chuxing, Dyson (private), Electric Last Mile Solutions Inc. (“ELMS”) (OTC:ELMSQ), Ferrari NV (RACE), Guangzhou Automobile Group Co., Hyliion Holdings (HYLN), Ideanomics Inc. (IDEX), Mahindra & Mahindra (OTC:MAHDY), Niu Technologies (NIU), Proterra (PTRA), Qiantu Motor, Sono Group N.V (SEV), Subaru (OTCPK:FUJHY), Suzuki Motor Corp. [TYO: 7269] (OTCPK:SZKMY) (OTCPK:SZKMF), Vinfast, WM Motor, and Zhi Dou (private).

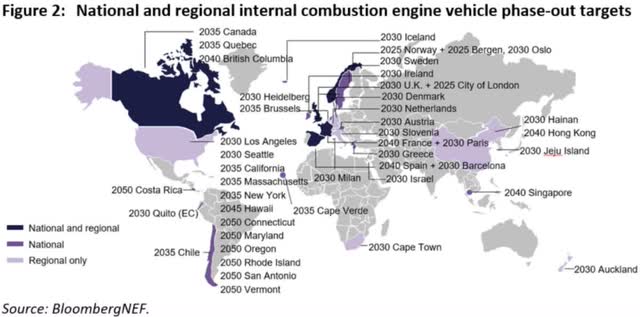

The list of countries and cities banning (or planning to ban) petrol and diesel vehicles include at least:

- Norway (2025); UK, Netherlands, Denmark, Sweden, Iceland, Greece, Ireland, Israel (2030); Scotland (2032); Hong Kong (2030-40); EU, Germany, Japan, Canada (2035); France, Spain, Egypt, Taiwan, Singapore, India, New Zealand and Poland (2040).

- Rome (2024); Athens, Paris, London, Stuttgart, Mexico City, Madrid (2025); Amsterdam, Brussels, Hainan (2030); California, New York, Quebec Province (2035); Sao Paolo, Seoul (2040).

Conclusion

February 2023 global plugin electric car sales were 812,000 up 49% YoY and reached 14% global market share; 33% share in China, 20% in Europe, and 7.6% for the USA (quoted in March 2023).

Highlights for the month were:

- Ola plans to build world’s largest electric vehicle hub in India.

- China’s Provinces offer EV sweeteners as national subsidies fade.

- Smartphone giant Xiaomi confirms 2024 launch for electric saloon.

- VinFast EV production in US now not expected to start until 2025.

- US loosens IRA requirements with EU mineral supply deal.

- EU releases their Critical Raw Materials Act proposal.

- BMI – “EV demand sentiment was weighed on by some automakers in China heavily discounting ICE vehicles, by as much as 50% for some models in advance of new emissions standards expected to come into effect on 1 July 2023.”

- CPCA expects China’s Mar NEV retail sales of 560,000 units, up 25.8% from a year ago and up 27.5% from February, 2023.

- UN adopts landmark resolution to define global legal obligations on climate change.

- Biden makes electric vehicle credits elusive in bid for US auto renaissance. Biden admin plans to propose ‘toughest-ever US curbs’ on auto pollution – report.

- BYD CEO Wang expects China’s NEV sales to be 8.5 to 9 million units in 2023, with penetration rates of up to 40 to 45%. BYD aims to sell at least 3 million vehicles this year.

- Tesla vows to halve EV production costs, Musk keeps affordable car plan under wraps. Tesla may start production in Mexico as early as 2024 according to the governor of Nuevo Leon. Tesla prepares to make 4 million units of its cheap electric car, supply chain sources say.

- Volkswagen plans to invest 180B euros (US$192.6B) between 2023 and 2027, more than two thirds targeting “electrification and digitalization.” Volkswagen aims to be the global leader in cheap EVs. Audi confirms more than 10 EVs by 2025, including entry-level model.

- SAIC-GM-Wuling launches Wuling Bin Guo EV in China, priced from only RMB 59,800 (~US$8,700).

- Stellantis plans the first fully electric Ram vehicles from 2023 and Jeep from 2024 in USA.

- Mercedes set to invest billions in e-vehicles plants in China, Germany and Hungary over the coming years.

- Kia reveals the all new electric Kia EV9. Kia and Hyundai mini EVs to hit the streets in 2023.

- GM’s EV push stalls amid slow rollouts for GMC Hummer, Cadillac Lyriq.

- Ford tripling F-150 Lightning, doubling Mach E production in 2023. Launches the new all-electric Ford Explorer. Ford sees EV losses growing to $3B in 2023. Ford next-generation electric truck code-named “T3,” short for “TrustTheTruck.”

- XPeng launches new P7i Sports Sedan in China.

- Mitsubishi Motors plays catchup with plans to electrify fleet by 2035.

- Lucid to lay off 1,300 employees for $24-$30M restructuring plan.

- Toyota and BYD first co-developed electric bZ3 rolls off the line in China for under $30K. Toyota looks to overhaul EV strategy as new CEO takes charge.

- Nikola announces $100.0 million Public Offering of Common Stock.

- Fisker Alaska EV truck to have ‘Amazing Features’ never before seen on pickups.TakeCharge did not write this article.

Original post credited to SeekingAlpha Here.